Home Insurance is Changing—Is Your Roof Still Covered?

Home Insurance is Changing—Is Your Roof Still Covered?

Homeowners nationwide are seeing major shifts in their insurance policies. Premiums from top insurers like State Farm, Allstate, Progressive, Liberty Mutual, and Farmers are rising, deductibles are increasing, and many policies now contain clauses significantly limiting coverage for roofing claims. If your home insurance doesn't cover roof damage like it used to, you're not alone.

Higher Deductibles and Reduced Roof Coverage

One of the most significant changes in home insurance is higher deductibles specifically for roof claims. What was once a $500 or $1,000 deductible has now increased to a percentage of your home's insured value, potentially costing you thousands out-of-pocket when you file a claim.

Moreover, insurers including State Farm, Allstate, Progressive, Liberty Mutual, and Farmers have started applying pro-rated coverage for shingle roofs. This means your insurer may only cover a portion of your roofing costs based on the age of your shingles, leaving you responsible for the rest.

Why are Insurers Reducing Roof Coverage?

Insurance companies are facing increased payouts for roof replacements due to severe weather, storm damage, and aging roofs. To control these rising costs, insurers are shifting more financial responsibility back onto homeowners.

This shift makes proactive roof maintenance essential.

Protect Your Roof and Your Wallet with Fresh Roof

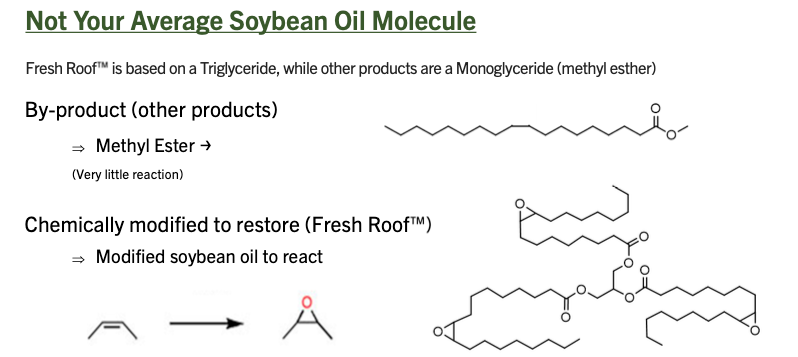

Fresh Roof is an effective and affordable way to prolong the life and condition of your asphalt shingles. This specialized treatment rejuvenates your shingles, enhancing waterproofing capabilities, restoring flexibility, and boosting durability against harsh weather.

By maintaining your roof with Fresh Roof, you can:

- Extend Your Roof’s Life: Delay or eliminate costly roof replacements by maintaining healthy shingles.

- Minimize Out-of-Pocket Costs: As deductibles rise and coverage shrinks, proactive roof maintenance means fewer unexpected expenses.

- Preserve Your Home's Value: A well-maintained roof protects your home's overall value and prevents expensive interior damage.

Stay Ahead of Insurance Changes

Don’t wait until it’s too late. With insurance coverage from companies like State Farm, Allstate, Progressive, Liberty Mutual, and Farmers becoming increasingly restrictive, maintaining your roof proactively with Fresh Roof is more important than ever. It's a smart way to ensure you're protected from large, unforeseen roofing expenses.

Ready to protect your home and save long-term? Contact us today to learn how Fresh Roof can help.

Click here to Get A Free Quote.